CWA District 9 has released the details of the Second Tentative Agreement that was reached between the Union and AT&T. All changes between the first and second TA are highlighted in yellow.

Below are the details as listed in the TA. The PDF will be available to download at the end of this post.

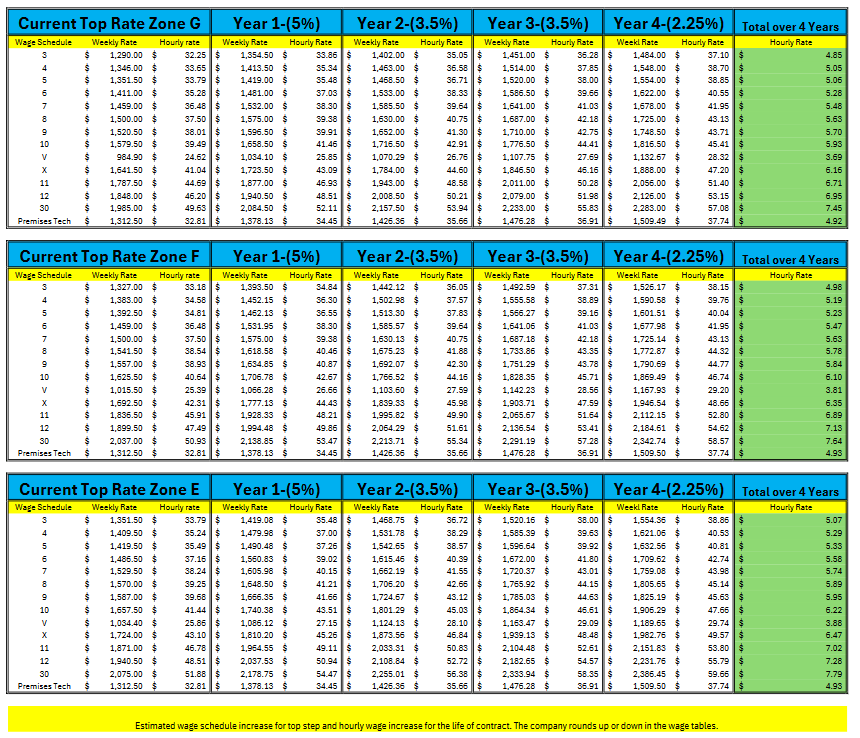

Wage Scale Breakdowns

Final Bargaining Report

Term of Contract

Wages and Other Compensation

Employment Security

Pension Benefits

Benefit Changes for Active Employees

Benefit Changes for Active Employees Effective 01/01/2026

Health Savings Account for Option 2

Annual Deductibles

Spouse/Partner Access to Medical Coverage Additional Medical Contribution

Tobacco Use Additional Medical Contribution

Prescription Drug Program (RX Plan)

Dental/Vision

Benefit Changes for Current Retirees

Tuition Aid

Articles

Appendices

MOA’s/Letters

Downloadable PDFs

Send us a question

Dear CWA District 9 Brothers, Sisters, and Siblings:

Before returning to the bargaining table, District 9 informed your bargaining team about the issues that needed to be addressed from the information they gathered from the local presidents. Taking into account the amount of mobilization and actions being conducted and understanding how close the other district was to getting a TA, your bargaining team went back to the table and worked for every improvement we could get. Below, you will find the details of the Tentative Agreement reached through an intense few days of bargaining that adds actual dollars to every member and improves Overtime rules in Appendix E, along with a 4×10 scheduling trial for Appendix E

Based on the feedback that was passed on from District 9, your elected bargaining team worked tirelessly to achieve an agreement that would be beneficial to all employees. The highlights of what was achieved are below:

1. Wages: 14.25% increase (more middle loaded) exponentially to all titles, compounded to 15.02%.

FULL RETRO PAY FOR EVERY TITLE

2. Employment Security: Article 2 was maintained; pooling MOA was maintained. Additional improvements to Appendix E.

3. Benefits: Maintained medical, dental, and vision. Added funded HSA (Health care spending account) for the high-deductible plan, two-tier system for medical was eliminated. Retained the SSP and 401K.

4. Working conditions: Appendix E improvements, overtime cap to 12 hours, added improved double time language over 52 hours, improved notification language for schedule changes, secured a 4×10 scheduling trial and permanently added MLK day as a paid Holiday for Appendix A and E, and memorialized the 4-day work week for the call center.

5. Other Goals and comments: Retained Horizons, increased tuition aid, maintained neutrality and card check along with Successorship language.

Out of the top 22 items on the survey, the following is a summary:

1. Base wage increase achieved.

2. Protect Healthcare achieved.

3. Retain 401K achieved.

4. Job security retained and limited improvements

5. Stop movement of work did not achieve.

6. Eliminate Subcontracting did not achieve.

7. Pension band increase yes traditional/BCB2 built in.

8. Preserve Article 2 achieve for active employees.

9. Retain SSP achieved.

10. Improve vacation and time off achieved MLK.

11. Ratification Bonus achieved lump sum

12. Pension increase for retirees did not achieve.

13. Maintain/improve Overtime Language achieved.

14. Retain ESB/VSB achieved.

15. Improve scheduling-6 days/weekends did not achieve.

16. Classroom training did not achieve.

17. Maintain/Improve differentials achieved/improve App E.

18. Title upgrades did not achieve.

19. Apprenticeship Program did not achieve.

20. Maintain/Improve Horizons Tuition aid achieved.

21. Improve expand Article 9 Safety did not achieve.

22. Address The issue of New Technology achieved

We want to thank those who were prepared and active prior to and through the negotiations. With this agreement every member will see an increase in their base salary. Over the life of the contract the average hourly pay wil increase by $5.88. Under this agreement, every member currently on the payroll will see improvements to his/her standard of living.

CWA District 9 Vice President

Frank Arce

Assistant to District 9 Vice President

Domoníque Thomas

CORE Bargaining Team

Michael Barfield- Bargaining Chair, Art Gonzalez, Chris Roberts, Jason Hall, John Miller

The Four-year contract is effective upon ratification through April 4, 2028.

14.25% raise over life of contract for a compounded wage increase of 15.02% with FULL RETRO

The general wage increase will be effective on the following dates:

April 7, 2024 – 5%

April 6, 2025 – 3.5%

April 5, 2026 – 3.5%

April 4, 2027 – 2.25%

*See charts for specifics, but by front loading the %, each member will receive more money in the life of the contract than previously agreed to.

The wage schedules will be modified to reflect this increase, exponentialized with no change in the start rate.

Retained and broadened Job Security provisions:

West Program:

Current Employees that continue to participate in the West Program will be eligible for the following pension band increases:

BCB2: (Covers any member hired after 2009)

Lump Sum

***In 2025, health, dental and vision costs will remain unchanged from 2024. This includes the same rates and plan designs for Kaiser, Option 1, and Option 2. Due to the tentative agreement’s ratification date being so close to the end of the year, we will not be able to implement the new benefits until 2026. Therefore, members can expect to continue with their current coverage and rates through 2025.

Immediate medical coverage for new hires

Added two new discounted tiers to the medical plan (individual + spouse, individual +children)

Maintained medical cost share of 29% for Company plan option

Kaiser Plan

Term of Kaiser Arrangement: Effective 1/1/2025 and terminates 12/31/2028.

Eligibility: Current Employees (eliminated 2 tier health care)

Plan Design: Same terms and conditions as provided by Kaiser to Current Employees who are

Eligible California Employees, subject to changes in law and the exceptions below (Kaiser Plan).

If the cost of Kaiser Plan to AT&T for the Plan Year is in excess of the cost to AT&T of the Company self-insured medical plan Option 1 Broad available to Eligible California Employees, monthly contributions will apply to Eligible California Employees who are enrolled in the Kaiser Plan during the Plan Year equal to the contributions outlined above, plus the cost difference between the Kaiser Plan and the Company self-insured plan Option 1 Broad plan for the coverage tier elected.

Employees who select Option 2 only, can elect to make pretax payroll contributions to an HSA (health savings account) up to the annual maximum set by the IRS.

The company will match up to the below amounts for employees who elect to make payroll contributions, in an amount equal or greater than the minimum amount outlined below.

Individual: $1,000

Family: $2,000

Out of Pocket Max Provisions:

If the coverage tier is Individual + Children, Individual + Spouse or Family:

In a health care plan, the out-of-pocket (OOP) maximum is the most an individual pays for covered services in a plan year before the plan starts covering 100% of eligible costs. For a family or Individual + Spouse or Individual + Child(ren) plan, each individual has their own OOP maximum. If one person in the family reaches their individual OOP max, their future medical expenses will be fully covered by the plan, even if the overall family OOP maximum hasn’t been reached. Other family members would continue to contribute toward their own expenses until either they reach their individual OOP max, or the family OOP max is met.

All Current Employees:

Spouse/Partner Access to Medical Coverage Additional Medical Contribution:

Participants whose spouse/partner enrolls in AT&T-sponsored medical coverage (within either self-

insured or fully insured programs) but otherwise has access to medical coverage through their employer, excluding AT&T, will pay an additional monthly contribution toward their cost of coverage.

The monthly additional contribution is shown below. The participant must attest that his or her spouse/partner does not have access to medical coverage otherwise the additional contribution will be applied.

Additional Monthly Medical Contribution:

2025 2026 2027 2028

$115** $125 $130 $135

**same as 2024

All Current Employees:

Tobacco Use Additional Medical Contribution:

Employees and/or spouses/partners who use tobacco, are enrolled in AT&T-sponsored medical coverage (within either self-insured or fully insured programs) and who choose not to participate in a designated Tobacco Cessation program will pay an additional monthly contribution toward their cost of coverage. The employee and/or spouse/partners must attest to no tobacco usage or engage in a Company-sponsored Tobacco Cessation program in the time defined during Annual Enrollment

otherwise the additional monthly contribution will be applied.

Engagement is currently defined as

enrollment, participation and completion. A tobacco user is currently defined as someone who has

used tobacco products more frequently than once a month. Tobacco products include cigarettes,

cigars, pipes, e-cigarettes, vaporizers and smokeless tobacco. The definitions of engagement, tobacco user, tobacco products and the terms of the Company-sponsored Tobacco Cessation program may change from time to time, at the sole discretion of the Company.

Additional Monthly Medical Contribution for each employee and/or spouse/partner:

2025. 2026 2027. 2028

$75. $75 $75 $75

Wellbeing Incentive*: Starting in 2026

Up to $750 annual individual reimbursement

*Incentives for participating in the AT&T sponsored wellbeing program in 2026

Cryopreservation and Surrogacy Reimbursement.

Maximum annual reimbursement for adoptions has been increased

-Vision and Dental Coverage has been extended for dependents until age 26 ** starting in 2026

Prescription Drug Program (RX Plan): Starting in 2026

Changes to RX plan in 2026:

1) Flat dollar copay amounts will be replaced with percentage coinsurance, meaning members will pay a

percentage of the cost of the drug (Option 1 – 10%, Option 2 – 30%) up to a maximum of $50 for generics

and $100 for preferred brand drugs for a 30-day supply.

2) Under the Option 1 plan, the annual deductible and out-of-pocket maximum will now apply to both medical services and prescription drugs. Previously under Option 1, prescription drugs had no deductible and a separate out-of-pocket maximum.

3) The Option 2 annual deductible and out of pocket maximum will continue to apply to both medical and

prescription drugs.

4) Maintenance drugs for chronic conditions like diabetes, asthma, hypertension, and congestive heart failure will be covered without a deductible.

5) New diet and weight loss medications will have expanded coverage.

All Current Employees

Option 1 Broad and Select:

Deductible: Now is Integrated with Med/Surg and MH/SA.

Retail – Network Coinsurance:

(Up to 30-day supply, Limited to 2 fills for maintenance)

2026-2028

Generic 10%

Preferred 10%

Non-Preferred 50%

Retail – Non-Network Coinsurance:

Participants pay the greater of the applicable Network coinsurance or balance remaining after the program pays 75% of network retail cost.

Mail Order Coinsurance:

(Up to 90-day supply)

2026-2028

Generic 10%

Preferred 10%

Non-Preferred 50%

Option 2 Broad and Select:

Deductible: Integrated with Med/Surg and MH/SA.

Any applicable coinsurance paid for preventive care drugs as permitted under section 223(c)(2)(C) of the IRS is not subject to the deductible

Out of Pocket Maximum – integrated with Med/Surg, MH/SA and CarePlus

Retail – Network Coinsurance:

(Up to 30-day supply, Limited to 2 fils for maintenance)

2026-2028

Generic 30%

Preferred 30%

Non-Preferred 50%

Retail – Non-Network Coinsurance:

Participants pay the greater of the applicable Network coinsurance or balance remaining after the program pays 75% of network retail cost.

Mail Order Coinsurance:

(Up to 90-day supply)

2026-2028

Generic 30%

Preferred 30%

Non-Preferred 50%

Disability Benefits:

Program:

2012 and 2009 New Hires and Current Employees

No Change from Current Program

2020 New Hires 2016 New Hires

No Change from Current Program

Short-Term Disability (STD):

No Change from Current Program

2012 and 2009 New Hires a n d Current Employees

No Change from Current Program

2020 New Hires and 2016 New Hires

No Change from Current Program

No improvements. Your Union Bargaining Committee requested to bargain for current retirees, but AT&T was very consistent with their response that they were not willing to bargain for current retirees, as current retiree benefits are not a mandatory subject of bargaining.

Annual tuition aid cap for full-time employees from $5,250 to $8,000.

Increase tuition lifetime caps for undergrade from $20,000 to $25,000.

Graduate from $25,000 to $30,000.

Article 1:

1.05 Contract distribution

Article 2:

Established new Separation benefits for New Hires

Article 3: No Change

Article 4: No Change

Article 5: No Change

Article 6: No Change

Martin Luther King Jr Day

Article 7: No Change

Article 8: No Change

Capped layoff table at 35 years

Article 9: No change

Article 10: No change

Conclusion – Date changes

Appendix A: No Changes

Appendix D: No Changes

Appendix E

Maintained all letters except those that had expired or completed:

Improved TWP Letter

Improved Wellness Program

Retained ESB

Retained Card Check

Retained Successorship

Retained GIIT (Consumer call center)

Retained Success Sharing Plan

Modified Horizon’s Training/Retraining Program

Modified Tuition Aid (Nanodegrees)

Retained National Transfer Plan (NTP)

Retained Pooling

Retained Sunday Plus Four

Retained MOA that Sales Consultant (Leverage rep) is not applicable to a Job Offer Guarantee.

Retained Company Paid Union Appointed Representative (B-Help)

Retained Wage Credit

Retained Office Closure MOA

Retained CVS Caremark letter

Retained Company Wellness Letter

Retained Technological change Moa Added Artificial Intelligence (A/I) letter

Respectfully Submitted, Bargaining Committee Members

Michael Barfield – Chair, Art Gonzalez, Chris Roberts, Jason Hall, John Miller

If you have a question about the Tentative agreement, please feel free to enter it in the form below. It will be sent to our leadership team who will respond as quickly as they can. We only ask for email and phone number so we can reach out to you with an answer to your question.